In Greek mythology, Tantalus angered the Gods and as punishment was made to stand in a pool of water beneath a tree with low-hanging fruit. When he was thirsty, the water would retreat just out of reach. If hunger struck, the tree branches would elevate so that he couldn’t reach the fruit.

What’s surprising is that there are more than a few people paying money for a watch enthusiast’s version of Tantalus’ fate by owning perfect Rolex replica watches that they can never touch, wear, or wind. They only get to look at photos.

Watch funds

In South Korea, an entrepreneur named Shin Beom-Jun recently launched a new platform called Piece. The value proposition is somewhat straightforward, but also potentially transformative for the secondary market in luxury 1:1 fake watches.

Piece identifies collectibles that it will buy with funding raised from individuals. It is akin to Kickstarter, but in this case Piece asks for funds to buy collectibles such as sneakers and (you guessed it) luxury AAA replica watches.

After a predetermined amount of time, the collectibles are sold back on the secondary market and the proceeds divided up among the investors. Assuming there is rapid appreciation in the value of the collectibles, everyone shares in the earnings.

The first fund opened on April 1, 2021 (I’m assuming the choice of April Fool’s Day was coincidental). The target: collectible top Rolex copy watches. The funding goal of approximately $106,000 was reached in about 30 minutes with 70 people contributing an average sum of roughly $1,500.

The legendary collector Alfredo Paramico established the Precious Time Fund around a decade ago. Limited public information suggests the fund has held (or holds?) a seven-to-eight-figure portfolio of timepieces.

South Korea’s Piece, though, is unique in several ways. First, the barrier to entry is quite low. The number of people who could potentially buy into this fund is large (although, having reviewed the materials I would recommend investors have a healthy understanding of Korean or access to a good translator).

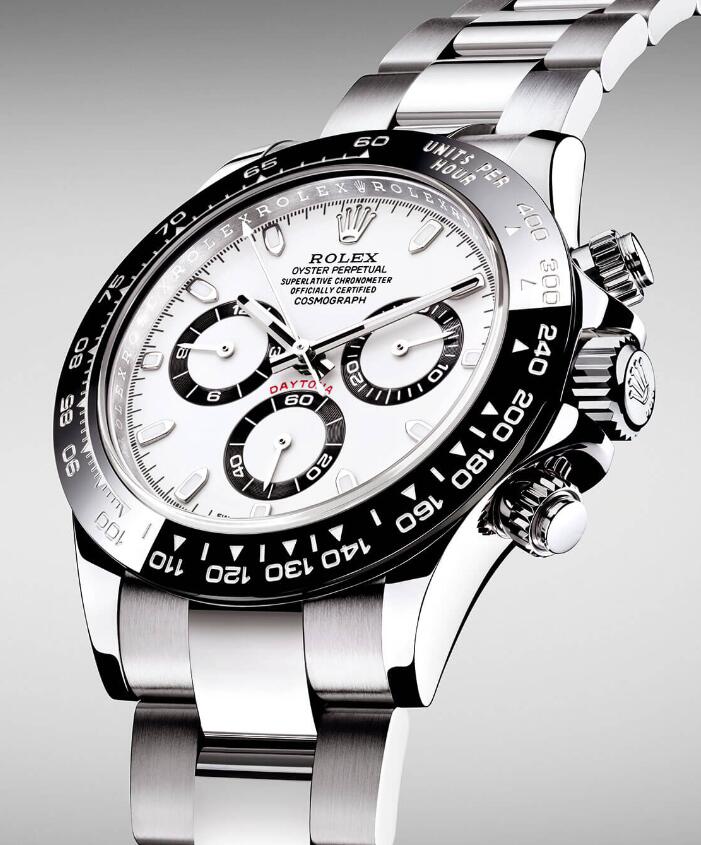

Second, the fund is remarkably transparent. It will buy 11 best Rolex replica watches, including two Oyster Perpetuals (Pink and Coral dials, References 126000 and 124300), a Cosmograph Daytona, two Submariners (a Hulk and a 41 mm, References 116610LV and 126000), and a green-dial Datejust 31 mm (likely Reference 278240).

The funds I mentioned earlier are mysteries in comparison. From what I can tell, they don’t even have web pages (the slide deck above is hosted on an independent site).

So what are we to make of watch buying funds?

While it is complicated, there are many reasons for concern bordering on dislike. Demand originating from these funds is, by and large, motivated by money and not interest in cheap Rolex super clone watches (one fund does claim to provide timepiece access to investors).

The funds almost certainly push up prices and, potentially, lengthen waitlists. It is reasonable to conclude that skyrocketing prices in recent years would be more modest if these funds did not exist. They also make it more difficult for traditional collectors to acquire timepieces and wear them.

There is also the question of “truth in advertising.”

The founder of Piece seems to suggest (based upon a computer translation of Korean) that 2024 China replica Rolex watches prices never go down. I’ve written elsewhere that this is simply not true. Piece also estimates a 25-27 percent return in six months (or roughly 50 percent at an annual rate). This is an extraordinary rate of return. What’s less clearly described is the level and source of risk in a watch-buying fund.

The case of the wholesale replica Rolex GMT-Master II Batman watches (Reference 116710BLNR) is illustrative. In March 2021, sales of this model on eBay were priced in the neighborhood of $15,000-$16,000. In no small part, this appreciation from a list price of $9,000 was driven by the 2019 discontinuation of the Oyster bracelet version.

In a surprise move, the model returned on an Oyster bracelet in April 2021. As a result, secondary prices have flatlined or, compared to March, actually declined. In May examples were sold on eBay for as little as $10,000.

There is not adequate discussion of the fact that the scarcity of modern luxury references is largely artificial.

If Rolex CEO Jean-Frédéric Dufour stares out across the field of discontinued references selling well above retail and decides he’s tired of leaving that money on the table, he can easily take it from speculators by resurrecting a reference. If you owned the reference he chooses, but you were not planning on selling, this would not impact your cashflow.

In fact, if brands truly dislike pure speculation, one could easily argue that it is their responsibility to pull the rug out from under skyrocketing prices.

Authorized dealers may also adversely respond to watch-buying funds; they’re an opportunity to surreptitiously earn more than list price. An authorized dealer can sell desirable pieces at list to the fund manager and place the proceeds in the fund, thereby earning a market return not available to collectors.

I was surprised that the Piece fund was so confident in its ability to acquire 11 highly sought-after references and wondered if this was the reason. If authorized dealers sell more inventory to watch-buying funds, fewer Swiss movements super clone watches become available to true collectors.

Watch-buying funds are not entirely problematic, though. I can appreciate the fact that Piece democratizes access to the watch market, allowing smaller-scale investors to enjoy a potential run-up in luxury watch prices.

Even for collectors, watch-buying funds can potentially short-circuit seller’s remorse. I’ve been on more than one Zoom call in which a collector has bemoaned selling a watch only to see it later significantly appreciate in value.

If you simultaneously sell a Rolex Hulk while placing some portion of the proceeds in a fund like Piece, you will still partially benefit from an appreciation in the reference’s value. In this sense, watch-buying funds can act as a hedge.

It remains to be seen whether watch-buying funds will become a larger factor in the market for timepieces. As the regular drumbeat of new price records continues, we can’t ignore the possibility that watch funds (or perhaps other novel arrangements) may be part of the cause.

While opinions may vary on whether this is a welcome development, it is undeniably part of the ever-widening interest in luxury fake watches site. From that perspective, watch-buying funds are something that we should probably embrace with trepidation.